June 12, 2023 — Among the results of the Texas Legislature‘s examination and approval of possible upgrades for the ERCOT (and non-ERCOT) grid system in the state are several bills that have now become law with their signing by Governor Greg Abbott in the past several days.

June 12, 2023 — Among the results of the Texas Legislature‘s examination and approval of possible upgrades for the ERCOT (and non-ERCOT) grid system in the state are several bills that have now become law with their signing by Governor Greg Abbott in the past several days.

One thing is clear: The state legislature has endorsed for now, with some substantial changes, the Performance Credit Mechanism for ERCOT.

Two bills that could result in the building of more power plants have been getting all the publicity. They are:

Senate Bill 2627 (signed by the Governor but requires a public vote on November 7th of this year) — creating the Texas Energy Fund, providing up to $10 billion in loans and grants to incentivize the construction, maintenance and operation of electric generating facilities to ensure the reliability of the ERCOT grid.

At the signing, Governor Abbott said, “It provides low-interest loans for the construction of up to 10,000 MW of new dispatchable power generation and provides related completion bonuses to help bringing facilities online as quickly as possible. Companies must apply for those loans by the end of the year. And it provides grants for backup power and improvement of transmission and distribution facilities for non-ERCOT regions of Texas.”

The bill requires a change to the Constitution of Texas and therefore a public vote is needed through SJR 93, which has been filed with Secretary of State Jane Nelson.

House Bill 1500, the “Sunset Bill for the Public Utility Commission of Texas and the Office of Public Utility Counsel,” which Governor Abbott said “ensures greater public stakeholder input at commission meetings” and “clarifies the PUC’s complete oversight of ERCOT and established guardrails” over the PCM (the Performance Credit Mechanism) ensuring that “costs associated with building new transmission lines are more evenly shared between the generation resource and the broader customer base.”

It also instructs ERCOT to “procure a new ancillary service designed to help ERCOT account for certain operational challenges” and establishes “performance requirements for certain generation resources to ensure a more reliable and predictable grid.”

And it instructs ERCOT to “make information related to unplanned outages of generation resources more publicly accessible and provides for a greater transparency in reporting of any potential misconduct in the ERCOT market.”

The PUC adopted the PCM just after the start of the just-ended regular legislative session, helping to ensure that new power plants are profitable while paying bonuses to reliable power plants for firing up when needed.

The Texas Senate added more than a dozen new guidelines as amendments to the original HB 1500 for companies to gain the credits, adding a penalty up to $1 million for a violation of a voluntary mitigation plan, defining some energy resource references, requirement of notice of “material” unplanned service interruptions within a reasonable time, adding the “postage stamp” method of pricing and adding more duties for the PUC, among other changes.

It becomes effective September 1st.

9 Other Bills Now Law

Among the lesser-known bills that are now law following the governor’s signing:

SB 2013 — “This bill protects the Texas electric grid from hostile foreign nations and actors,” Governor Abbott said at the signing ceremony. It’s aimed at “ensuring…

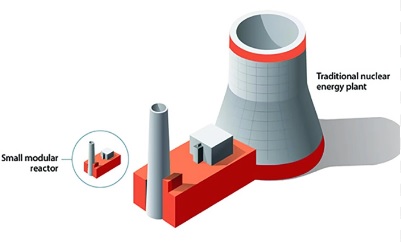

June 13, 2023 — Modular nuclear reactor company X-Energy Reactor and Ares Acquisition Corporation have revised downward the valuation of their partnership from $2.1 billion to $1.8 billion with hope of establishing a more attractive entry point for investors — but the re-valuation doesn’t affect the partnership’s proposed advanced small modular reactor nuclear project at the Dow Seadrift plant near Freeport.

June 13, 2023 — Modular nuclear reactor company X-Energy Reactor and Ares Acquisition Corporation have revised downward the valuation of their partnership from $2.1 billion to $1.8 billion with hope of establishing a more attractive entry point for investors — but the re-valuation doesn’t affect the partnership’s proposed advanced small modular reactor nuclear project at the Dow Seadrift plant near Freeport. June 13, 2023 — The move toward increasing energy conservation is underway in Texas with Governor Greg Abbott‘s signing on Monday of a bill from the Texas Legislature to bring a statewide framework for the implementation of natural gas-saving programs.

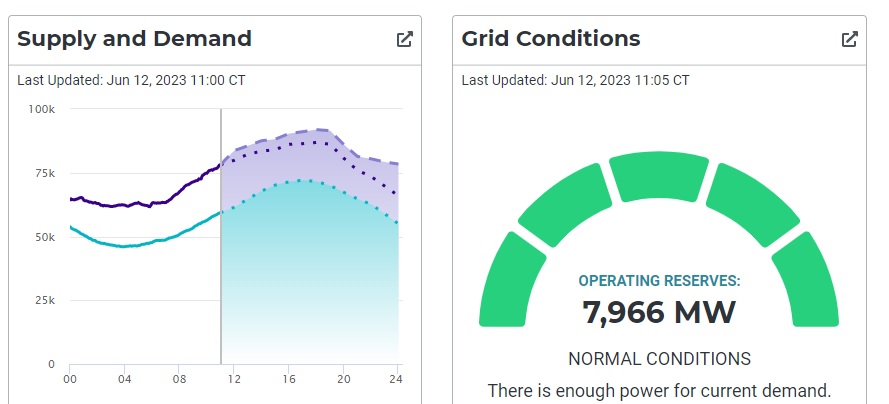

June 13, 2023 — The move toward increasing energy conservation is underway in Texas with Governor Greg Abbott‘s signing on Monday of a bill from the Texas Legislature to bring a statewide framework for the implementation of natural gas-saving programs. June 12, 2023 – ERCOT has launched the ERCOT Contingency Reserve Service (ECRS), a new daily procured Ancillary Service. As energy demand continues to grow in Texas, adding ECRS will support grid reliability and mitigate real-time operational issues to keep supply and demand balanced.

June 12, 2023 – ERCOT has launched the ERCOT Contingency Reserve Service (ECRS), a new daily procured Ancillary Service. As energy demand continues to grow in Texas, adding ECRS will support grid reliability and mitigate real-time operational issues to keep supply and demand balanced. June 12, 2023 — Among the results of the Texas Legislature‘s examination and approval of possible upgrades for the ERCOT (and non-ERCOT) grid system in the state are several bills that have now become law with their signing by Governor Greg Abbott in the past several days.

June 12, 2023 — Among the results of the Texas Legislature‘s examination and approval of possible upgrades for the ERCOT (and non-ERCOT) grid system in the state are several bills that have now become law with their signing by Governor Greg Abbott in the past several days.

June 2, 2023 — Texas PUC Chairman Peter Lake has resigned effective July 1st, Gov. Greg Abbott announced on Friday, with Chairman Lake drawing praise for his tumultuous tenure while the Governor said he would name a replacement.

June 2, 2023 — Texas PUC Chairman Peter Lake has resigned effective July 1st, Gov. Greg Abbott announced on Friday, with Chairman Lake drawing praise for his tumultuous tenure while the Governor said he would name a replacement.