We expect rapid electricity demand growth in Texas and the mid-Atlantic: EIA

July 31, 2025 —

Data values: U.S. Regional Electricity Sales to Ultimate Customers and U.S. Regional Electricity Generation, Electric Power Sector

In our most recent Short-Term Energy Outlook (STEO), we forecast nationwide U.S. retail electricity sales to ultimate customers will grow at an annual rate of 2.2% in both 2025 and 2026, compared with average growth of 0.8% between 2020 and 2024. The forecast reflects rapid electricity demand growth in Texas and several mid-Atlantic states, where the grid is managed by the Electric Reliability Council of Texas (ERCOT) and the PJM Interconnection, respectively. We expect electricity demand in ERCOT to grow at an average rate of 11% in 2025 and 2026 while the PJM region grows by 4%.

After relatively little change in U.S. electricity demand between 2005 and 2020, retail sales of electricity have begun growing again, driven by rising demand in the commercial and industrial sectors. Developers have proposed numerous data centers and large manufacturing facilities that could consume significant amounts of electricity, and many of these projects are concentrated in the ERCOT and PJM regions. But, the timing of these facilities’ initial operations remains uncertain.

We publish short-term forecasts for electricity sales to ultimate customers for each of the nine census divisions and for the entire United States. We directly incorporate ERCOT’s and PJM‘s monthly projections for power demand into our sales forecasts for the relevant regions. The portion of the power grid that ERCOT operates is located within the West South Central Census Division, which consists of Texas and three neighboring states: Oklahoma, Louisiana, and Arkansas. In Texas, electricity is delivered to end-use customers by four large investor-owned utilities and several municipal utilities.

U.S. proved reserves fell in 2023 from 2022 record: EIA

Data values: U.S. crude oil and natural gas proved reserves 1963–2023

July 16, 2025 — U.S. proved reserves of crude oil and lease condensate totaled 46 billion barrels at year-end 2023, a 4% decline from the previous year’s record, according to our U.S. Crude Oil and Natural Gas Proved Reserves, Year-End 2023 report. U.S. proved reserves of natural gas fell to 604 trillion cubic feet, a 13% decline from their 2022 record. Both declines marked the first annual decrease in U.S. proved reserves for those fuels since 2020.

Proved reserves are operator estimates of the volumes of oil and natural gas that geological and engineering data demonstrate with reasonable certainty to be recoverable in the future from known reservoirs under existing economic and operating conditions. Prices heavily affect estimates of proved reserves.

Operators revised their proved reserves downward in response to falling prices in 2023 from the historical highs observed in 2022. Annual average wholesale prices at the domestic benchmarks for West Texas Intermediate crude oil and Henry Hub natural gas fell by 18% and 61%, respectively, between 2022 and 2023.

Final Tally of Energy Bills In the 29th Texas Legislature + Bills That Didn’t Make It

June 24, 2025 — Lawmakers ultimately passed 1,213 bills and more than 2,200 resolutions, including constitutional amendments, this session; Abbott has until 11:59 p.m. on June 22, 20 days after the session ends, to veto items in the budget or veto bills that passed in the last 10 days of the session. He has the same deadline to sign bills, according to the Dallas Morning News

BILL NUMBERS ARE IN BLUE AND INCLUDE LINKS TO THE BILL, DISPOSITIONS OF BILLS ARE IN RED, BILL SUBJECT CATEGORIES ARE IN GREEN

BILLS FROM THIS SESSION BECOMING LAW; SIGNED, FILED OR VETOED BY THE GOVERNOR

OIL AND GAS

OIL AND GAS: RRC to oversee task force to address petroleum product theft in the state; would direct the Railroad Commission of Texas to oversee the task force, which would recommend solutions to address petroleum-product theft throughout the state. The group would be made up of industry stakeholders and law enforcement agencies. The bill also mandates that the task force submit a report every two years outlining “recommendations to increase transparency, improve security, enhance consumer protections, prevent the theft of petroleum products, and address the long-term economic impact of the theft of petroleum products.” Authored by Republican Sen. Kevin Sparks of Midland

Passed the Senate and House, with the Senate concurring with House amendments,signed by the Governor May 20th, effective September 1st

____________________________

BILLS FROM THIS SESSION BECOMING LAW

OIL AND GAS: Credit or refund for diesel fuel taxes paid on diesel fuel used in this state by auxiliary power units or power take-off equipment.

SB 771

Passed by the Senate April 30th, passed by the House May 12th, sent to the Governor May 13th, filed without the Governor’s signature May 24th; Effective September 1st

____________________________

BILLS FROM THIS SESSION BECOMING LAW

OIL AND GAS: An interstate compact for the LNG industry for states that border the Gulf of America; establishes the Gulf States Liquefied Natural Gas Industry Compact, authorizing the Governor of Texas to develop and enter into an interstate compact with other Gulf Coast states to promote the liquefied natural gas (LNG) industry. The compact is designed to facilitate collaboration between member states on issues affecting the LNG sector, particularly focusing on the sharing of information, resources, and services to enhance the protection, growth, and operational efficiency of LNG operations along the Gulf of Mexico.

Passed the House, now leaving the Senate Natural Resources committee with a substitute bill, passed by the Senate May 16th, sent to the Governor May 17th, signed by the Governor My 28th, effective immediately

_________________________

BILLS FROM THIS SESSION BECOMING LAW

OIL AND GAS: Declaration of an oil or gas emergency by the Railroad Commission of Texas and the liability of a person for assistance, advice, or resources provided in relation to an oil or gas emergency

Senator Brian Birdwell (Republican) is the author

Passed the Senate, passed the House as amended May 6th, signed by the Governor May 27th

_________________________

BILLS FROM THIS SESSION BECOMING LAW

OIL AND GAS: Imposition of application fees for certain permits and permit amendments for the disposal of oil and gas waste; Senator Judith Zaffirini (Democrat) is the author

Passed the Senate and the House on May 15th, signed by the Governor May 27th, effective September 1st

(companion bill not passed, HB 3158 Drew Darby is an author; left after second reading in the House, companion bill SB 2122 considered instead)

____________________________

BILLS FROM THIS SESSION BECOMING LAW

OIL AND GAS: Taking on oil, gas and related products theft; “The inspection, purchase, sale, possession, storage, transportation, and disposal of petroleum products, oil and gas equipment, and oil and gas waste; creating criminal offenses and increasing the punishment for an existing criminal offense; bill seeks to address the challenges posed by organized oilfield theft by setting out provisions relating to the inspection, purchase, sale, possession, storage, transportation, and disposal of petroleum products, oil and gas equipment, and oil and gas waste in order to provide law enforcement with clear authority to inspect and investigate suspected oil and gas theft, strengthen existing penalties, and modernize and reinforce the state’s legal response to oilfield theft and improper disposal practices”; Senator Kevin Sparks (Republican) is the author

Passed the House April 16th, passed the Senate with agreement on House amendments, sent to the Governor May 7th, signed by the Governor May 19th

____________________________

BILLS FROM THIS SESSION BECOMING LAW

OIL AND GAS: Authorizes the Texas Commission on Environmental Quality to issue permits for land application of produced water — wastewater that comes out of the ground during the extraction of oil and gas production — and develop standards that prevent pollution of surface and groundwater.

Passed the Senate March 13th, passed the House April 29th, sent to the Governor May 1st, signed by the Governor May 13th

____________________

BILLS FROM THIS SESSION BECOMING LAW

OIL AND GAS: Inactive wells

Plugging of and reporting on inactive wells subject to the jurisdiction of the Railroad Commission of Texas; authorizing an administrative penalty; would create a severance tax exemption to provide incentives for oil and gas operators to bring inactive gas and oil wells back into production

Has passed the Senate, passed out of the House Energy Resources committee on May 8th with substitute bill, passed the House on May 28th, sent to the Governor May 28th, signed by the Governor on June 20th

(companion bill not passed HB 2766 “Relating to the plugging of certain inactive wells subject to the jurisdiction of the Railroad Commission of Texas” Pending in House Energy Resources committee since April 7th)

____________________

BILLS FROM THIS SESSION BECOMING LAW

OIL AND GAS: A severance tax exemption for oil and gas produced from certain restimulation wells; Representative Drew Darby (Republican) is the author

Substitute bill passed the House on May 15th, passed the Senate May 26th, sent to the Governor May 28th, signed by the Governor June 20th, effective January 1, 2026

(companion bill SB 782 Left pending in the Senate Finance committee on May 14th)

________________________

BILLS FROM THIS SESSION BECOMING LAW

OIL AND GAS: Applicability of certain safety provisions and regulatory fees administered by the Railroad Commission of Texas to gas distribution…

Texas Oil Tax Income Way Down In May, Natural Gas Way Up

June 4, 2025 — Oil and natural gas tax income to the State of Texas is up and down.

Oil production taxes for the month of May 2025 were down 26% when compared to May 2024, while natural gas taxes were up 26% for the same period, according to the latest figures from the state Comptroller.

Oil production brought in $441 million while natural gas brought in $227 million in May.

Motor fuel tax income was up 4% year-over-year in May, totaling $339 million.

Motor vehicle sales and rental taxes were up 9% over May a year ago, at $693 million.

Overall, the state sales tax revenue totaled…

Feared “Anti-Renewables” Bills Die; Texas Legislature Does Pretty Good For Environmental Agenda

May 29, 2025 — Some feared “anti-renewables” bills failed to pass the state legislature in the current session, which closes down (and will be adjourned Sine Die!) Monday.

Many of them, despite widespread fear mongering by lobbyists and some Texas journalists, were never much of a threat to renewables.

Meanwhile, the bigger picture indicates that the Texas Legislature passed bills this session that would speed up permitting for home solar and energy storage installations, require licensing of solar power systems salespeople (after claims of consumer solar rip-offs have been greatly increasing) and would make certain that the oil and gas industry cleans up all those leaking, non-producing wells.

HB 3356 was among the most criticized as “anti-renewable energy,” yet it never came close to passing. In fact it never left the Texas House of Representatives, where it was debated in…

Gulf States Liquefied Natural Gas Industry Compact Bill to Become Law

May 29, 2025 — Governor Greg Abbott has signed into law House Bill 2890, which establishes the Gulf States Liquefied Natural Gas Industry Compact.

The bill takes effect immediately.

It authorizes Governor Abbott to develop and then enter into an interstate compact with other Gulf Coast states to promote the LNG industry. Republican Representative Jared Patterson is the author

The compact is designed to facilitate collaboration between member states on issues affecting the LNG sector, particularly focusing on the sharing of information, resources, and services to enhance the protection, growth, and operational efficiency of LNG operations along the Gulf…

Governor Abbott Signs Bill Increasing Penalties for O&G Theft

May 21, 2025 — A bill cracking down on organized oilfield theft has been signed by Governor Greg Abbott.

SB 1806, authored by state Senator Kevin Sparks, provides law enforcement with new, clearer authority to inspect and investigate suspected oil and gas theft and possible organizations involved, and also strengthens some existing penalties.

It will also “modernize and reinforce the state’s…

Legislature Passes Bill Giving No More Than 24 Hours Notice for TCEQ Water Tests

May 21st, 2025 — The Texas Legislature has passed and sent to Governor Greg Abbott a bill aimed at keeping water testing by the Texas Commission on Environmental Quality more accurate by mandating that the agency give no more than 24 hours notice before it tests water.

SB 1662 is simply a procedure in which a customer files a complaint against a water company, and the TCEQ is…

Legislature Passes Bill Establishing LNG Industry Compact

May 14, 2025 — The Texas Legislature has passed a bill that sets up a Gulf States Liquefied Natural Gas Industry Compact, which empowers the the Governor to develop and establish or join an interstate compact with other states along the Gulf Coast to promote the liquefied natural gas (LNG) industry.

HB 2890 passed the Texas House of Representatives on April 23rd in an engrossed version, which was then passed to the Senate and was then passed on May 14th by a final vote. The bill now…

USGS Releases Assessment of Undiscovered Oil & Gas Resources In the Hosston and Travis Peak Formations Along the Gulf Coast

May 8, 2025 — The U.S. Geological Survey released its assessment of potential for undiscovered oil and gas in two formations under much of the Gulf of America Coast from Texas to Florida, assessing that there are technically recoverable resources of 35.8 trillion cubic feet of gas and 28 million barrels of oil.

The estimate for today’s assessment is as much gas as the United States consumes in 14 months at the current rate of consumption. Since exploration began in the area, the Hosston and Travis Peak Formations have produced 8 trillion cubic feet of natural gas, as well as 126 million barrels of oil.

“USGS energy assessments typically focus on undiscovered resources – areas where science tells us there may be a resource that industry hasn’t discovered yet. In this case, our assessment found substantial resources of gas,” said Sarah Ryker, acting director of the USGS.

The onshore Gulf Coast is a major energy production area thanks to a world-class petroleum system and extensive energy exploration and production infrastructure. This assessment is limited to the Hosston and Travis Peak formations, which comprise a small portion of the onshore Gulf Coast’s Cretaceous aged rocks. While the study area stretches from the Mexican border along the Gulf of America to most of Florida, resources are concentrated in one sliver extending from southeastern Texas across central Louisiana through the Mississippi Delta and into state waters of Louisiana, in the Hosston-Travis…

70-Year-Old Nuclear Fusion Problem Solved, Helps Prevent Sustaining Plasma Inside Fusion Reactors: UT

By Ameya Palega

May 7, 2025 — Scientists at the University of Texas at Austin, Los Alamos National Laboratory, and Type One Energy Group in the US have finally solved a problem that has troubled fusion energy research for 70 long years. Using a novel symmetry theory approach, the collaboration has resolved a hurdle that has prevented sustaining plasma inside fusion reactors.

Nuclear fusion technology promises abundant clean energy with no planet-warming gases or risk of highly radioactive waste. Research in this field has been ongoing for decades but has picked up pace in recent years, with the National Ignition Facility (NIF) even demonstrating a net energy gain from fusion reactions.

The challenge, however, in scaling up nuclear fusion has been containing high-energy particles within the walls of the reactor. For fusion to occur, isotopes of hydrogen are heated to temperatures greater than those on the surface of the Sun and exist in a fourth state of matter called plasma, before fusing to form helium molecules and releasing energy.

However, at these temperatures and high energy states, alpha particles leak from the fusion reactor, causing the plasma to become less dense. As the plasma loses heat, it can no longer…

Water Is the New Oil (Again): Shoring Up Water Supply, Curbing Demand Key to Texas’ Future Growth — Dallas Fed

Texas’ strong economic growth depends on a steady supply of fresh water. Without significant investment, however, the state could face shortages during future droughts. Supply can be bolstered with reservoirs, reuse and conservation. Additionally, a transition to market-based policies could allow price signals to more efficiently mediate supply and demand.

Water is essential to the expanding Texas economy and its ability to continue outpacing U.S. growth. However, Texas’ increasing demand for water is running up against its current supply, which is already stressed by extreme heat and more frequent droughts.

Funding for water infrastructure improvements has emerged as a priority for the Legislature during its 2025 legislative session. Absent changes to policy, Texans could face significant water shortages during droughts and constraints on future growth and economic development.

Gauging potential water shortages

The Texas Water Development Board produces the State Water Plan, a blueprint that addresses supply and demand for water during droughts. In 2022, the agency estimated that if a severe drought (“drought of record”) were to occur in 2030, the state would be short 4.7 million acre-feet—more than 20 percent of projected demand.

One acre-foot of water is enough to supply two to three homes for a year. It is a unit of measure equivalent to the amount needed to cover an acre with a foot of water.

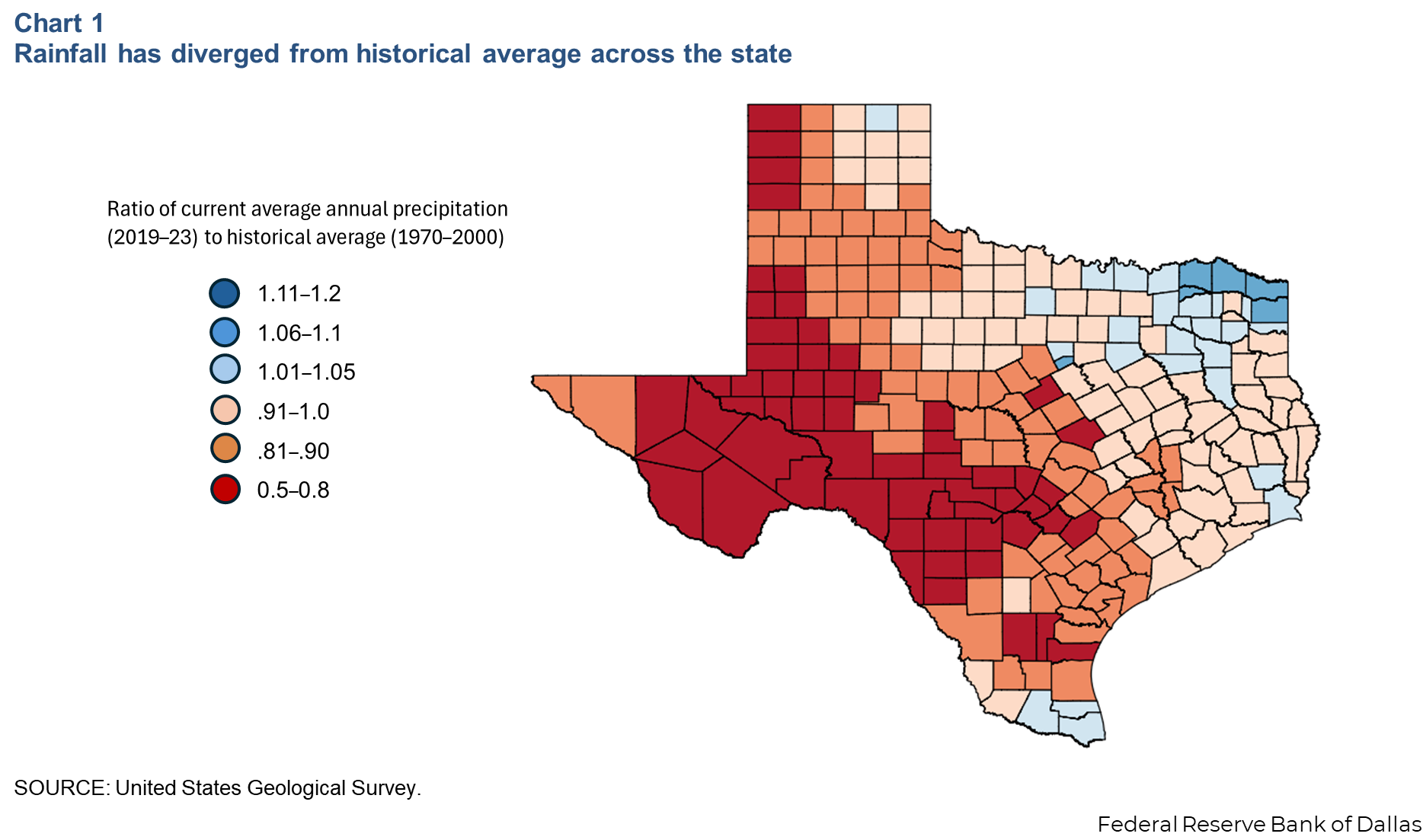

Water resources and potential shortages are highly regional because of Texas’ size. In recent years, portions of East Texas experienced near- or above-normal rainfall, while the western half of the state was drier than normal (Chart 1).

Some Texas communities already face extremely low water supplies. Reservoirs in the Rio Grande Valley are below 25 percent capacity. As a result, Brownsville has limited car washing and landscape irrigation and drained city swimming pools to reduce water demand. The city of Mission has weighed a moratorium on new construction, and Corpus Christi has restricted residential yard watering to conserve water. Areas in central Texas, including Austin, have implemented similar measures as Lakes Buchanan and Travis hover around half capacity.

Rapid urban growth and depletion of the Ogallala Aquifer, a prominent water source for agriculture in the Panhandle and West Texas, will exacerbate the impact of future droughts. Under severe drought conditions, the shortage could total 6.9 million acre-feet per year in 2070 if the State Water Plan’s recommendations are not implemented.

Rules differ for groundwater, surface water sources

Texas agricultural users draw mainly from groundwater supplies, while municipal and industrial users rely on both surface water and groundwater.

Nine major aquifers and several minor ones hold groundwater. Texas assigns groundwater rights using the rule of capture, which gives landowners the legal right to the water under their property. Groundwater conservation districts can, however, require well permitting or regulate the pumping and spacing of wells.

Aquifers recharge naturally as rainwater percolates through the ground. Some aquifers recharge quickly; the Ogallala Aquifer does not. The State Water Plan projects groundwater availability will fall 25 percent from 2020 to 2070, partly because of the Ogallala’s depletion.

By comparison, the state owns surface water and grants water rights to users such as cities, utilities, firms and individual landowners. River authorities or watermasters administer water use on some river systems, including the Rio Grande, the Brazos and the Lower Colorado. During a drought, the users with the longest-standing permits tend to take priority.

Regulators manage surface water availability with storm and wastewater capture and reuse, stream diversion and reservoirs. Some metro areas are heavily dependent on surface water. The greater Dallas–Fort Worth area sources 89 percent of its water demand from surface water.

Water demand to grow as economy, population expand

The State Water Plan anticipates water demand increasing 9 percent during the half century ending in 2070, mostly because of population-growth-driven municipal water consumption.

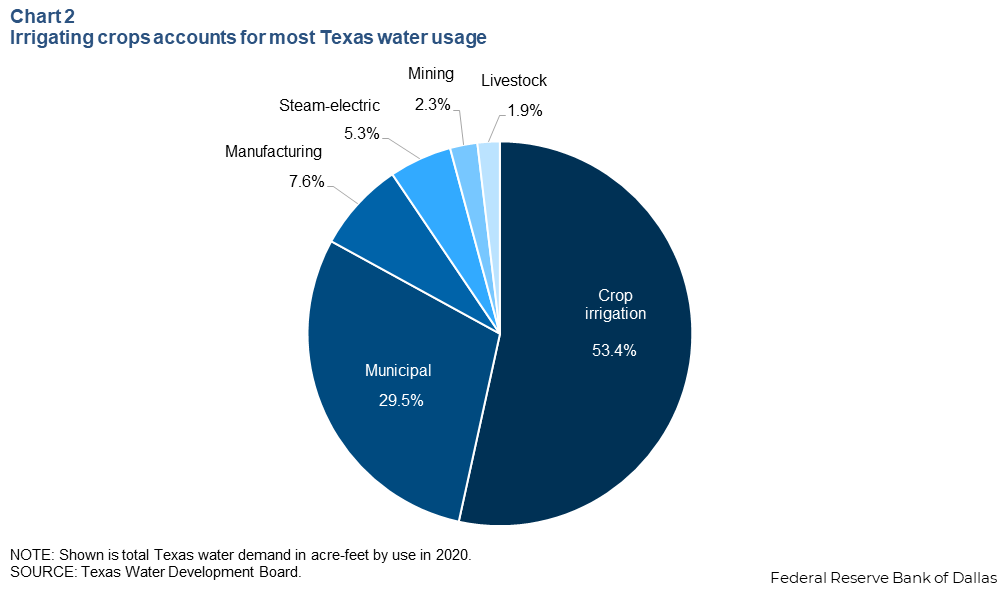

Crop irrigation accounts for the majority of water use in Texas (Chart 2). Farmers and ranchers used 9.8 million acre-feet of water in 2020—mainly groundwater, and much of it from the Ogallala Aquifer.

…

…Eagle Ford Natural Gas Production Increases as Crude Oil Production Holds Steady: EIA

In our April Short-Term Energy Outlook, we forecast U.S. annual natural gas production from the Eagle Ford region in southwest Texas will grow from 6.8 billion cubic feet per day (Bcf/d) in 2024 to 7.0 Bcf/d in 2026. The increase in natural gas production comes as natural gas prices rise and demand for liquefied natural gas exports grows. Oil production in the Eagle Ford, on the other hand, has hovered around 1.1 million barrels per day (b/d) since 2020, and we forecast it will remain about the same through 2026.

This increase in natural gas production with stable oil production in the Eagle Ford region is a result of increasing gas-oil ratios. As more oil and natural gas are produced, pressure within the reservoir declines, allowing more natural gas relative to oil to be produced.

The Eagle Ford region contains many plays, the largest of which are the Eagle Ford play and the Austin…

Texas Lawmaker Seeks to Improve Texas’ Power Capacity by Joining Regional Grid and Agreeing to Federal Oversight

Electrical grids are vulnerable to climate change, which amplifies intense heat and drought in the summer and intensifies storms in the winter. Nowhere is the problem more pronounced than in Texas, as recent history has shown.

Texas has the added challenge of running its own power grid that doesn’t cross state lines and connect extensively to neighboring regional grids—by design, thus enabling the state to evade regulation by the Federal Energy Regulatory Commission.

So it’s been hard for Texas in times of extreme heat or intense storms to come up with the power it needs at times of peak demand when, in the age of climate change, having adequate, reliable power can prevent people from freezing or sweltering to death in their homes.

“Broadening your interconnection reduces your risks and increases your reliability,” said Dennis Wamsted, an energy analyst at the Institute for Energy Economics and Financial Analysis, a nonprofit energy policy research group, who noted the need for building interregional transmission lines. The lines are expensive to build, he said, but interconnection could lower energy costs once the transmission lines are built.

Now, freshman U.S. Rep. Greg Casar, a former a labor organizer, Austin City Council standout and rising progressive star in Texas, has introduced legislation that would establish power connections across state borders that he said would prevent climate-related blackouts as well as aid the transition to clean energy and cut electricity bills.

He also wants $11 billion from a federal Department…

Texas Senate Approves Credit Program for Dispatchable Generation: Hogan Lovells

Update: The bill passed the Senate last month has now moved to the House State Affairs committee

On March 24, 2025, the Texas Senate passed S.B. 388, a bill establishing a mandatory program for “dispatchable” power credits. The proposed program generally resembles programs established in other states to incent the construction of renewable and, in a few cases, nuclear resources. The stated intention of the program is to ensure that 50% of new capacity installed from 2026 onwards is “dispatchable.” Dispatchable is defined in contrast to “non-dispatchable” which is defined as being controlled primarily by forces outside of human control. However, battery storage, which is generally considered a dispatchable power resource, is expressly excluded from the credit program. S.B. 388 passed in an 18-13 vote, largely along party lines. The bill now heads to the Texas House of Representatives for consideration.

Technically speaking, the program is not entirely new—it repurposes an existing program that was never implemented. S.B. 388 is an amendment to Section 39.9044 of Texas’ Utilities Code, which was adopted as part of Texas’ restructuring of the electricity markets to encourage competition. Section 39.9044 created a natural gas energy credit trading program with the goal of encouraging 50% of megawatt generating capacity installed after 2000 to use natural gas. The goal was to incent the construction of competitive and efficient gas-fired generation over the nuclear and coal fired generation that dominated the industry at the time. However, the natural gas credit program never went into effect.

S.B. 388 amends Section 39.9044 to ensure that 50% of the megawatts of generation capacity installed in the Energy Reliability Council of Texas (“ERCOT”) region after January 1, 2026, be sourced from “dispatchable” generation other than battery energy storage. Specifically, S.B. 388 requires the Public Utilities Commission of Texas (“PUCT”) to activate a dispatchable …

Bill Expediting Home Energy Storage, Solar, Goes to Texas House

Update: The House Land & Resource Management committee approved a committee substitute bill as of April 17th

April 3, 2025 — A bill to expedite the approval process for home energy storage and solar applications was quickly approved by the Senate Business and Commerce Committee in late March, was quickly passed by the Texas Senate and is now in the queue for attention by the state House.

After representatives from the Texas Solar and Storage Association joined Tesla and the Texas Advanced Energy Business Alliance in testifying in favor of the bill, the committee unanimously sent SB 1202 off to the full Senate.

The bill, sponsored by Republican Senator Bill King, would streamline the approval process in allowing licensed engineers and other third parties to conduct required home inspections and review applicable regulatory documents, which frees up the process of installation by no longer requiring regulatory agencies to inspect and review paperwork.

The bill passed the Texas Senate on March 31st and was received by the House on April 1st, where it’s awaiting action.

Following submission to the regulatory agency within 15 days by engineers or outside inspectors, then a decision by the regulatory agency would be…

The Texas Hydrogen Industry Needs Water, New Study Provides Details on How Much: UT Austin

There are many ways to make hydrogen — a carbon-free energy source and petrochemical ingredient. But no matter the method, all hydrogen production requires a lot of water.

In a recent study, researchers from The University of Texas at Austin examined just how much water the growing Texas hydrogen economy might need. They found that by 2050 new hydrogen production facilities could account for 2–6.8% of water demand in the state.

In comparison to big water draws, such as irrigation or municipal use, hydrogen’s demand is relatively small, said the study’s lead author Ning Lin, an energy economist at UT’s Bureau of Economic Geology. But it has the potential to disproportionately affect communities that face future water issues.

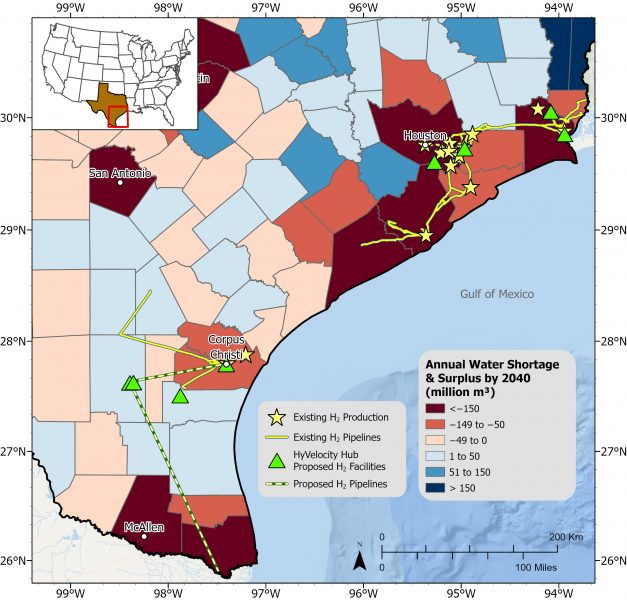

This includes the Gulf Coast, where most current hydrogen infrastructure is built and where most new hydrogen infrastructure is planned. The State Water Plan projects this region to face large annual shortages of fresh groundwater by 2040.

Two Views: The Future of the Precious Resource Water In Texas, in HB 16 and SB 7

See the House version of this bill, HB 16, by clicking here

See the Senate version of this bill, SB 7, by clicking here

March 20, 2025 — A new bill has been introduced in the Texas Legislature, with a goal for the overall improvement of state water management. Texas House Bill 16 would extend the “powers and responsibilities” of the Texas Water Development Board. District 8 State Rep. Cody Harris (R), has sponsored a bill to broaden the role of the board members. The board manages several responsibilities pertaining to the state water supply such as, collecting and distributing relevant data, assisting with planning, budget, wastewater treatment, flood oversight and agricultural conservation operations.

“Last session, we took a major step forward by creating the Texas Water Fund—approved by 78% of voters. But our work isn’t done. HB 16 expands funding eligibility, prioritizes critical infrastructure repairs, and ensures every dollar is spent wisely,” Harris said. “HJR 7 takes it further by proposing a constitutional amendment to dedicate up to $2 billion in sales tax revenue over the biennium to secure Texas’ water future.”

Should HB 16 pass the board would have more flexibility to carry out their duties for instance:

- Increased authority over water infrastructure development regarding storage, collecting or diverting of water

- Decisions will be subjected to less legislative oversight

- Permission to implement performance and accountability by conducting water assessments

- Granted more revenue from sales tax to increase budget

The bill will be subject to voter approval during the regular session and if it passes, it will take effect on Jan. 1, 2026. — KTEK/MSN

From the Greater Houston Partnership:

Texas lawmakers are moving forward with securing the state’s long-term water future with sweeping new legislation aimed at increasing water availability and funding critical infrastructure improvements. Senate Bill 7 (SB 7) lays out a comprehensive framework to address these challenges, reinforcing the state’s commitment to sustainable water solutions.

The Partnership joins Texas 2036, a leading voice in the statewide coalition, in supporting this critical initiative. Filed by Sen. Charles Perry in early March, SB 7 represents one of the most anticipated policy measures of the legislative session.

Here’s a look at the proposed legislation in both chambers.

What’s in the Bill?

Sen. Perry was emphatic about the need for Texas to deliver a solution. “Water scarcity is no longer a distant threat,” the senator said in his Thursday press release announcing the bill’s filing. “It’s here, and it’s already disrupting the lives of Texans across the state. From West and South Texas, where agriculture is being strangled, to communities struggling to keep up with economic and industrial growth, the lack of water has become the biggest limiting factor for our state’s future.”

For decades, Sen. Perry has been a leading voice on this issue. SB 7 is the culmination of decades of work that saw its first taste of victory in 2023 with the creation of the Texas Water Fund. In SB 7, the plan includes three key components: expanded authority for the Texas Water Development Board to deliver funding for water projects, enhanced legislative oversight through the restructured Texas Water Fund Advisory Committee, and improved reporting and accountability measures.

What are ‘Sweeping Changes’?

SB 7 is targeting the following initiatives to bring new water resources across the Lone Star State:

- Creates the Texas Water Fund Advisory Committee to provide oversight of all Texas Water Fund activities

- Requires the Texas Water Development Board (TWBD) to submit a biennial progress report to the Legislature regarding projects financed with Texas Water Fund money

- Creates the Office of Water Supply Conveyance Coordination to optimize water supply infrastructure construction for regional and statewide interconnection and interoperability

- Protects non-saline groundwater reserves in the state’s rapidly depleting freshwater aquifers

- Preserves local control over surface water rights

- Authorizes TWDB’s state water bank program to purchase out-of-state water for importation to meet the needs of Texans across the state

- Expands both project eligibility for financing from the New Water Supply for Texas Fund and the available methods of financing

- Prioritizes wastewater treatment projects in rural communities and small cities for financial assistance

- Adds the Flood Infrastructure Fund to the Texas Water Fund structure, allowing flood projects to be financed using the funding stream constitutionally dedicated by Senate Joint Resolution 66.

Click here to download the one-pager outlining the goals for SB 7 and Senate Joint Resolution 66.

What is in the House Bill?

There are many similarities between SB 7 and House Bill 16 (HB 16) by Representative Cody Harris. The latter is broader in scope, with differences in approach to water infrastructure development, financial allocations, legislative oversight, and reporting measures. Here are several highlights from HB 16:

- Expands funding for produced water treatment projects, excluding those identified for oil and gas exploration

- Emphasizes prioritization of rural populations (less than 150,000) and projects with significant progress on state/federal permitting

- Allows funding transfers for the economically distressed areas program account and ensures funding for public water awareness, water conservation, and water loss mitigation

- Slightly modifies the makeup of Texas Water Fund Advisory Committee—including a seat for Texas Department of Emergency Management

- Expands the duties of the committee to conduct regular reviews of historically underutilized businesses participation, annual reports on statewide supply expansion, and direct oversight of state water project funding

- Requires regular reports to the legislature with updates on project delivery, completed infrastructure repairs and economic benefits of funded projects

What’s Next?

HB 16 has already been referred to the House Committee on Natural Resources. SB 7 will likely be referred to the Senate Committee on Water, Agriculture, and Rural Affairs, which Sen. Perry chairs.

Two Views: House Bill 14 on Texas Development of Advanced Nuclear Reactors from Public Citizen & TPPF

See the introduced version of HB 14 by clicking here

See the introduced version of the similar bill in the Texas Senate, SB 2967, by clicking here

March 20, 2025 — From the Texas Public Policy Foundation: “Authored by Representative Cody Harris, HB 14 proposes a framework to support the development and deployment of advanced nuclear reactors in Texas for the purpose of bolstering energy security and economic growth through strategic collaboration, investment, and enhanced regulatory programs.

“The Electric Reliability Council of Texas (ERCOT) forecasts that Texas’ total annual load will double from 2023 to 2029 (ERCOT, 2024a, p. 4). While that amount of growth will not be realized in this decade, even realizing a portion of that growth demands more reliable and scalable electricity generation capacity in the ERCOT region. Nuclear energy will be essential in meeting this growing demand over the next decades. As the federal government reduces regulations and expands opportunities for nuclear development, Texas has the capability to lead the nation in the deployment of advanced nuclear reactors.” See the entire statement by clicking here

From Public Citizen: Re: HB 14, Nuclear Energy – Public Citizen testimony in opposition

Dear Chairman King and Members of the Committee:

On behalf of 30,000 members and supporters in Texas, Public Citizen appreciates the opportunity to testify against HB 14, relating to funding mechanisms within the Office of the Governor and Texas Public Utility Commission to support the deployment of advanced nuclear reactors in this state. We must oppose this bill because we do not think taxpayer dollars should support unproven nuclear technologies and we do not believe the bill will lead to more affordable energy on the ERCOT grid within a reasonable time.

Tier 1 and 2 payments are available before a project generates any electricity.

HB 14’s tiered payment system provides grant funding for projects at three separate tiers of completion, as follows.

- Tier 1 is for initial development costs.

- Tier 2 is for costs associated with construction, with 30% of a grant awarded while the nuclear commission is considering the application and 70% awarded after the final investment decision is made by the company building the project. Tier 2 funds can even be given for costs incurred before a project enrolls in the Texas Advanced Nuclear Deployment program.

- Tier 3 is for projects that are activated and operating and are awarded on a per megawatt basis.

This means that projects can be awarded Tier 1 and 2 funds without generating any electricity at all. The bill does includes a provision that Tier 1 and 2 agreements may include a requirement to repay funds if no operating license is obtained. If this bill moves forward, we recommend a deadline for generating electricity be set, with any project not meeting that deadline required to return funds. See the entire statement by clicking here

RRC Successfully Complies with Well Plugging Grants: RRC

March 20, 2025 — The U.S. Department of the Interior Office of the Inspector General has released an audit report showing the Railroad Commission of Texas successfully used federal grant funding for orphaned well plugging and complied with all related laws and regulations.

The RRC utilized its 40 years of well plugging expertise to expend a $25 million Initial Grant from the Infrastructure Investment and Jobs Act (IIJA) passed by Congress. The agency plugged more than 760 orphaned wells through the Initial Grant.

The Inspector General concluded that “We found that the State of Texas properly expended IIJA orphaned well initial grant funds and fulfilled program goals in accordance with applicable laws, Federal regulations, and grant terms…We make no recommendations as there are not reportable findings.” The audit also noted that the RRC “performs enhanced monitoring on all the contractual work performed on the well-plugging using IIJA funds” submitting daily reports on all completed work and costs as well as performing three levels of review to ensure invoice accuracy.

The majority of oil and gas wells that are no longer producing are plugged by the responsible operators. If an operator is non-compliant or goes out of business the well is considered orphaned, and the Railroad Commission administers a program to plug the wells. The IIJA grants supplement state funds that are used annually to plug orphaned wells across the state.

The RRC is now utilizing the first phase of IIJA Formula Grants to plug wells. However, the formula grants include administrative hurdles that are not specified in the IIJA, such as reviews of Endangered Species Act compliance and compliance with the National Historic Preservation Act, that significantly delay plugging projects. In fact, in the first 12 months of the IIJA Formula Grant, the RRC plugged 45 percent fewer wells using federal funds than were plugged during the first 12 months of the IIJA Initial Grant due to the reviews.

“We are proud to remain a leader in well plugging efforts nationwide and look forward to working with the new Secretary of the Interior to expeditiously plug wells in Texas,” said RRC Executive Director Wei Wang. “According to a recent Interstate Oil and Gas Compact Commission…