Plastic Pyrolysis − Chemists Explain a Technique Attempting to Tackle Plastic Waste by Bringing the Heat

By &

March 20, 2025 — Because plastic is so commonly used, finding new ways to manage and recycle plastic waste is becoming ever more important. Plastic waste pyrolysis is one technology that could help address this issue.

This is a relatively new technique, so researchers still have only a limited knowledge of the pyrolysis process. As analytical chemists, we strive to understand the composition of complex mixtures, especially new creations from sources such as plastic waste pyrolysis.

What is plastic pyrolysis?

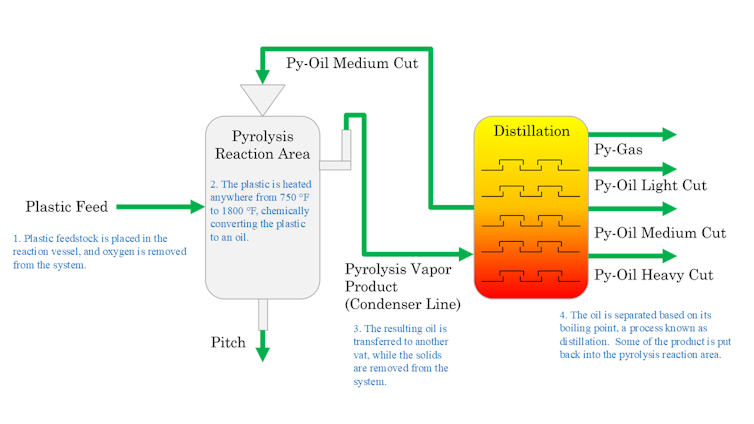

Plastic pyrolysis is a chemical process that involves chemically breaking down plastics into other molecules by heating the plastics to extremely high temperatures in the absence of oxygen.

Unlike traditional plastic recycling, pyrolysis theoretically isn’t limited to specific types of plastic. It could be made to accommodate many of them, although current technology is limited to a few types – polyethylene and polypropylene, used in food containers and bottles – at an industrial scale.

So, plastic pyrolysis could help handle the waste from consumer products such as plastic bags, bottles, milk jugs, packaging materials, wet wipes and even discarded children’s toys. Pyrolysis can also handle more complex plastic waste such as tires and discarded electronics, although solid waste handlers and recyclers avoid certain plastic types in pyrolysis, such as polyvinyl chloride – or PVC, which is found in pipes and roofing products – and polystyrene, used in packaging, as these can create harmful byproducts.

During pyrolysis, the plastic polymers are broken down into smaller molecules, resulting in the production of liquid oil, fuel source gases such as methane, propane and butane, and char.

Char is the solid residue left at the end of the pyrolysis process. It can be used as a carbon-rich material for various applications, including adding it to soil to make it healthier for farming, as it increases soil moisture and pH, benefiting nutrient absorption. Char also has the ability to absorb harmful carbon gases from the air, which can help prevent climate change.

The main downside of char is if it’s used too much it can increase soil alkalinity, which may hinder plant growth.

How pyrolosis works

The plastic pyrolysis process typically involves several key steps.

In the first step of pyrolysis, community recyclers collect the plastic waste and clean it to remove any contaminants. The plastic then gets shredded into smaller…